Boom Lift Rental in Tuscaloosa, AL: Locate Cost Effective Choices for Your Jobs

Boom Lift Rental in Tuscaloosa, AL: Locate Cost Effective Choices for Your Jobs

Blog Article

Exploring the Financial Conveniences of Leasing Construction Equipment Contrasted to Possessing It Long-Term

The choice in between owning and renting construction equipment is essential for economic management in the industry. Renting out deals immediate cost financial savings and operational adaptability, allowing business to assign resources more effectively. Understanding these nuances is crucial, particularly when considering how they straighten with particular task requirements and monetary strategies.

Cost Comparison: Leasing Vs. Having

When evaluating the financial effects of possessing versus renting out building and construction tools, a complete price comparison is important for making notified choices. The selection between having and renting out can dramatically influence a firm's bottom line, and recognizing the linked expenses is important.

Leasing building devices commonly entails lower in advance costs, permitting businesses to allot resources to various other functional demands. Rental contracts often include adaptable terms, making it possible for companies to access progressed machinery without lasting dedications. This versatility can be specifically useful for short-term jobs or rising and fall workloads. Nonetheless, rental expenses can build up in time, potentially surpassing the expenditure of possession if equipment is needed for an extensive period.

Alternatively, having building devices requires a substantial first investment, together with continuous prices such as insurance policy, financing, and devaluation. While possession can lead to lasting financial savings, it additionally ties up resources and might not give the same degree of versatility as leasing. In addition, owning devices necessitates a commitment to its use, which may not always straighten with task demands.

Inevitably, the choice to rent or own must be based upon a comprehensive analysis of certain task needs, monetary ability, and long-term calculated objectives.

Maintenance Obligations and expenditures

The option between having and renting building and construction tools not only involves financial considerations however likewise incorporates ongoing upkeep expenses and responsibilities. Possessing tools needs a significant dedication to its upkeep, which includes routine examinations, fixings, and possible upgrades. These obligations can swiftly build up, causing unexpected costs that can stress a spending plan.

On the other hand, when leasing devices, upkeep is usually the responsibility of the rental business. This arrangement permits specialists to avoid the economic burden related to wear and tear, in addition to the logistical obstacles of scheduling fixings. Rental contracts often consist of stipulations for maintenance, meaning that service providers can concentrate on completing projects as opposed to stressing over equipment problem.

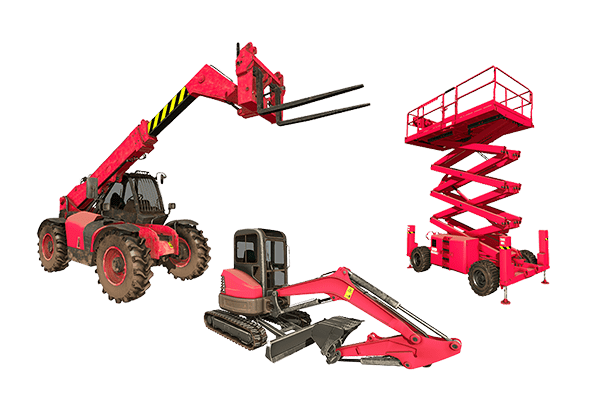

Moreover, the diverse variety of devices offered for rent makes it possible for firms to choose the most recent versions with innovative technology, which can boost efficiency and productivity - scissor lift rental in Tuscaloosa, AL. By deciding for leasings, businesses can avoid the long-lasting liability of tools depreciation and the connected maintenance frustrations. Eventually, evaluating upkeep expenses and responsibilities is essential for making a notified choice about whether to possess or rent building and construction equipment, substantially influencing overall task expenses and functional effectiveness

Devaluation Influence on Possession

A substantial element to consider in the decision to possess building tools is the influence of depreciation on general ownership expenses. Devaluation represents the decrease in worth of the tools in time, affected by elements such as usage, damage, and improvements in technology. As equipment ages, its market price lessens, which can considerably impact the proprietor's financial setting when it comes time to sell or trade the tools.

For construction business, this depreciation can translate to substantial losses if the devices is not used to its max potential or if it lapses. Proprietors need to account for depreciation in their financial forecasts, which can lead to greater total expenses contrasted to renting. Additionally, the tax obligation effects of depreciation can be intricate; while it might provide some tax obligation benefits, these are often offset by the truth of lowered resale value.

Eventually, the worry of depreciation emphasizes the importance of comprehending the long-lasting economic navigate here commitment associated with having building and construction equipment. Companies should thoroughly examine exactly how often they will certainly utilize the devices and the prospective financial impact of depreciation to make an informed decision concerning possession versus renting click over here out.

Financial Versatility of Leasing

Leasing building devices provides considerable monetary flexibility, enabling firms to allocate sources more successfully. This flexibility is especially important in a sector defined by changing job demands and varying workloads. By opting to rent, organizations can avoid the significant resources outlay required for purchasing tools, maintaining cash money circulation for other operational demands.

Additionally, leasing equipment enables companies to tailor their equipment choices to specific project requirements without the long-term dedication related to possession. This means that organizations can easily scale their tools stock up or down based upon anticipated and present project demands. As a result, this flexibility minimizes the threat of over-investment in equipment that may come to be underutilized or outdated with time.

Another monetary advantage of renting out is the possibility for tax obligation benefits. Rental payments are commonly thought about operating expenses, permitting instant tax reductions, unlike devaluation on owned tools, which is spread out over a number of years. heavy duty grinder machine scissor lift rental in Tuscaloosa, AL. This prompt cost acknowledgment can even more enhance a firm's cash position

Long-Term Project Considerations

When reviewing the long-lasting demands of a building and construction service, the choice between possessing and renting devices comes to be a lot more complex. For jobs with extended timelines, buying devices may appear advantageous due to the capacity for reduced total prices.

The construction sector is progressing quickly, with brand-new tools offering boosted performance and safety and security features. This flexibility is particularly helpful for services that deal with varied tasks requiring various types of equipment.

Furthermore, financial stability plays an essential function. Owning devices frequently entails significant funding financial investment and devaluation issues, while renting permits more predictable budgeting and capital. Inevitably, the choice in between possessing and renting must be lined up with the calculated objectives of the building and construction service, taking into consideration both expected and current project needs.

Conclusion

In verdict, renting building and construction equipment offers substantial economic benefits over long-lasting possession. The minimized in advance expenses, removal of upkeep responsibilities, and evasion of devaluation add to boosted money flow and financial versatility. scissor lift rental in Tuscaloosa, AL. Additionally, rental repayments serve as prompt tax obligation reductions, better benefiting professionals. Eventually, the choice to rent out instead of very own aligns with the vibrant nature of building jobs, allowing for adaptability and accessibility to the most recent devices without the monetary worries connected with ownership.

As equipment ages, its market value diminishes, which can significantly affect the owner's economic position when it comes time to offer or trade the tools.

Renting out building devices supplies considerable financial adaptability, enabling companies to allot resources extra successfully.Furthermore, leasing tools makes it possible for business to customize their equipment selections to specific job needs without the long-term commitment linked with ownership.In final thought, leasing building and construction tools uses significant economic advantages over long-term possession. Inevitably, the decision to lease rather than own aligns with the vibrant nature of building and construction jobs, allowing for versatility and accessibility to the most recent devices without the financial concerns associated with possession.

Report this page